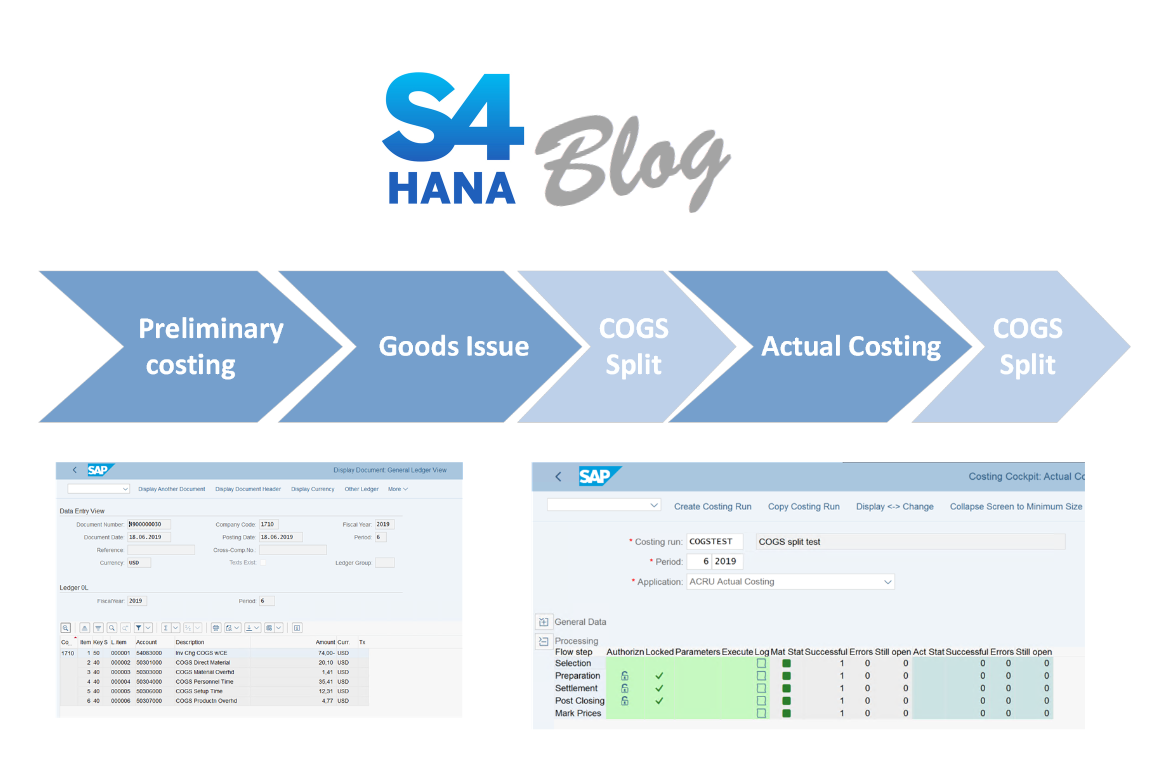

In my previous post about Finance in S/4HANA 1809 I highlighted the innovations in Account Based Profitability analysis. One of the innovations is the enhancements in splitting the cost of goods sold. We will have a more detailed look at this new functionality in this blogpost.

What’s new in 1809?

In the previous release 1709 the COGS split functionality was already enhanced and new supported processes were added. In release 1809 the functionality for splitting based on Actual Costing is added.

Splitting based on Actual Costing

The splitting functionality based on actual costing is enabled in 1809. Now you can split the revaluation of COGS as well. Doing this you have 2 options. You can post the revaluated amounts to the same accounts under the same cost component structure. Or you can post the revaluated amounts to a specific cost component structure. The configuration is changed slightly to facilitate this. You can see the new checkbox in the print screen below.

Don’t forget to add your revaluation account in the “Source Account” sections of the customizing. This is the account configured in T030 account key COC.

Perform the Split based on standard cost estimate

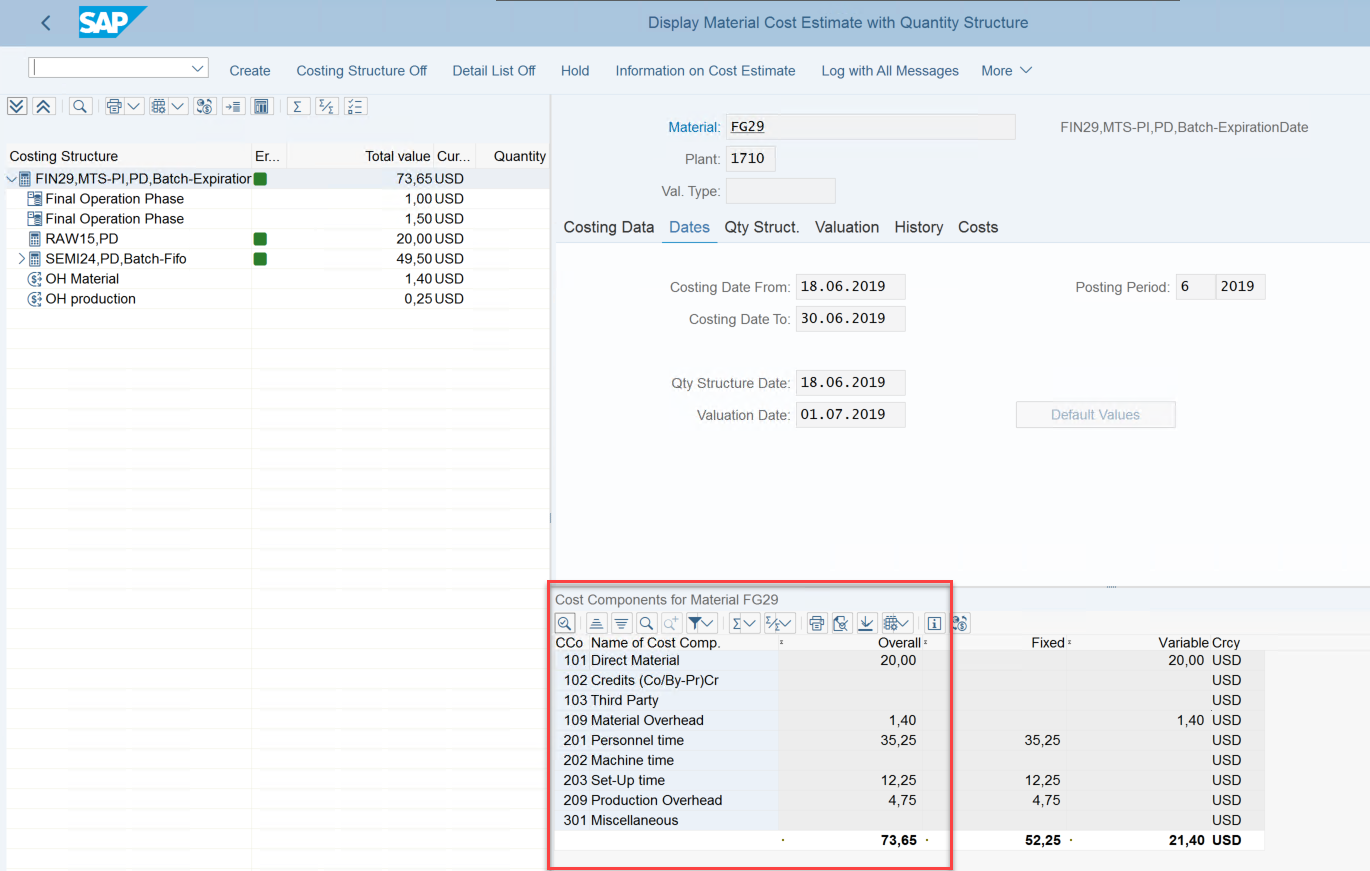

The standard cost estimate of the material used for preliminary costing during the period:

Sales order and delivery process

The splitting of the Cost of Goods sold during goods issue is a functionality which already available. You will see the enhanced functionality with splitting based on actual costing following the below example.

Posted accounting document during Goods Issue based on initial costing run:

The balances of the accounts in the financial statement App:

Alternatively, the amounts can be seen in the market segment analytics report as well:

Actual Costing and splitting the revaluation amount

In this example I have used a material valuated against standard price (S) with price determination Single Level/Multi Level (3). At month end I perform Actual Costing in CKMCLP:

There is a price difference of 2.45 USD:

As you can see the price difference of USD 2.45 is splitting based on the same cost component as the preliminary cost price.

The effect is visible in the Financial Statement app as well:

The benefits of having all dimensions on account level in ACDOCA is huge and the cons/disadvantages are disappearing with each new release. It is exiting to see that Account Based COPA is closing the gap.

10 comments

This is such a very good explanation on the enhancement made on splitting of COGS. Many company will be happy about this functionality. This will facilitate the analysis in the management accounting area of finance.

In the above Cost Component Structure Production overhead is shown as 4,77 USD. But if user wants to know again the sub break of the above 4,77 USD, like how much towards Consumables, Stores or some others expenses. User wants to track some 10/15 exp heads under production overhead. How that can be achieved both in plan & actual ?

hi,

granularity depends on your configuration. It is possible to have more lines in your costing sheet for overhead calculation. These lines can post to different GL accounts and you can map those in your COGS split. This applies both to plan as actual.

Hi Ugur.

Thanks for great explanation.

Do you know if it’s possible to split COGS based on auxiliary cost component sructure?

Regards,

Ugin

Hi thanks for your reply.

Actually during actual costing run the PPV in respect of purchases are not getting capturing correctly during consumption of SFG or FG. Suppose goods are purchased in 2 batches & PPV in respect of the same are 100 & 250 for 10 & 20 quantities respectively. Now while issuing for 7 quantities from batch 1, is it feasible by anyway to transfer only 70 as PPV ??

In the current scenario system is taking the average of PPV from both the batches & transferring the variances accordingly.

Hi Ugur,

This post helps me a lot!!

Thanks!

How can I split between fixed and variable costs?

You booked only the total amount of the cost component element of the calculation. Is it possible to separate between fixe and variable costs? This is very important for a correct contribution accounting (CM1 and CM2 (= Teilkostenrechnung Differenzierung nach Deckungsbeitrag 1 und 2)).

hi Frank, the total and fixed costs are stored in ACDOCA. You can calculate the variable in reporting (custom analytical queries). More detail in this OSS note: 3392509 – Fixed and variable amounts in COGS Split document.

https://me.sap.com/notes/0003392509

Fixed and variable amounts

Note 2399030 mentions: As of SAP S/4HANA 1909, in the COGS split document, the fixed portion is updated in the controlling area currency for the legal valuation, group valuation, and profit valuation (in the ACDOCA fields KFSL, KFSL2, and KFSL3) even if the currency/valuation is not set for the material ledger (see the restriction for sFin 1.0).

The fixed part is only updated in the controlling area currency. Similarly, it is not possible to split the variable and fixed portion to different accounts.

Our solution for fixed / variable amounts during COGS Split in Account-Based CO-PA is the “reporting solution”. We only save the fix part in Group Currency (KFSL, KFSL2, KFSL3) on database i.e. during COGS Split we only post fix part in these fields in group currency.

Customer can use these fields in order to calculate fix / variable part in other currencies on the fly i.e. in his analytical app (reports).

We take care that KSL, HSL and KFSL is filled during each COGS Split The total values of the different valuation views will also be stored in ACDOCA.

COGS split handles all currencies / valuations relevant for process / company code (entered in the currency configuration dependent on company code).

The fixed to total valuation is same for all currencies for a particular valuation type. It can differ for the same currency in a different valuation.

In case of legal valuation

You can calculate the fixed and variable part for all currencies e.g. for company code currency

HFSL (fix in company code currency) = KFSL * HSL / KSL

Same for the valuations e.g. profit center valuation in company code currency

HFSL3 = KFSL3 * HSL(profit center valuation) / KSL (profit center valuation) – dependent on which currency code is amount in profit center valuation.

There are however no fixed fields for the these parallel valuation data. The respective currency types need to be assigned to freely defined currencies in transaction FINSC_LEDGER.

Note 2344012 provides detailed information about currency setup in universal journal in S/4H.

Hello Ugur, thank you very much for your reply! This seems to be a work-around. Basically, however, the solution is not very user-friendly from SAP. It should be possible to post variable and fixed costs to separate

accounts as part of the COGS split. I don’t understand why SAP can’t do

this in the standard.