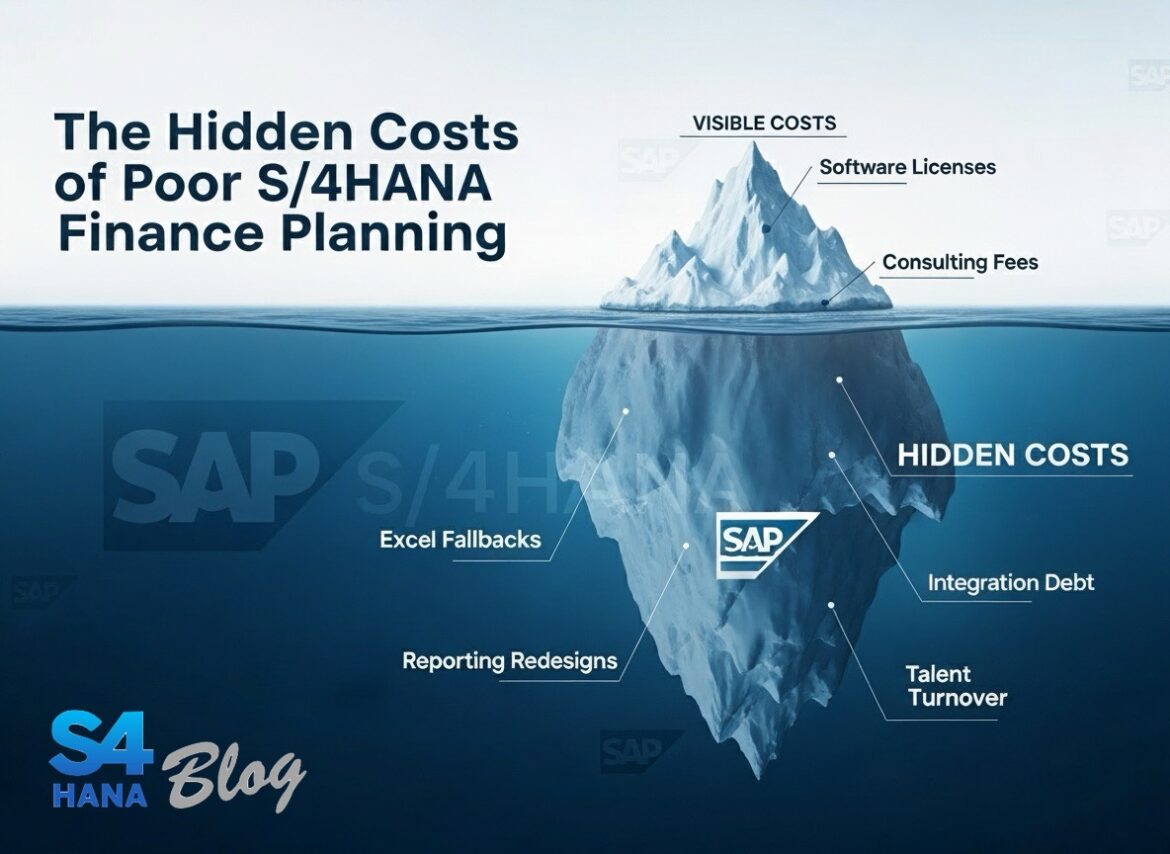

When CFOs embark on an S/4HANA transformation journey, they often focus on the visible costs: software licenses, implementation partners, and project timelines. However, the most devastating expenses often emerge from what’s hidden beneath the surface poor finance planning that turns a strategic investment into a costly burden.

After 15+ years of S/4HANA Finance implementations, I’ve witnessed firsthand how inadequate finance planning creates a cascade of hidden costs that can dwarf the original project budget.

The Real Cost of Finance as an Afterthought

1. The Excel Fallback Trap

Hidden Cost: $500K – $2M annually in lost productivity

When finance requirements aren’t properly defined upfront, organizations inevitably fall back on Excel for critical processes post-go-live. What seems like a temporary workaround becomes a permanent crutch, requiring dedicated resources to maintain complex spreadsheets, manual reconciliations, and error-prone reporting processes.

Real Impact: A global logistics company I worked with spent €1.2M annually on additional FTEs just to manage Excel-based processes that should have been automated within S/4HANA.

2. The Reporting Redesign Cycle

Hidden Cost: $200K – $800K per redesign cycle

Poor initial planning leads to reporting structures that don’t align with business needs. Finance teams discover critical gaps only after go-live, triggering expensive redesign cycles that could have been avoided with proper upfront planning.

The Pattern: Initial complaints surface 3-6 months post-go-live, followed by 12-18 months of costly modifications, testing, and re-training.

3. The Integration Debt

Hidden Cost: $300K – $1.5M in ongoing maintenance

When finance architecture isn’t properly planned, organizations end up with a patchwork of point solutions and custom integrations. Each additional system creates maintenance overhead, security vulnerabilities, and data consistency challenges.

4. The Talent Drain

Hidden Cost: $150K – $400K per departing finance professional

Nothing frustrates finance professionals more than being forced to work with poorly designed systems. High turnover in finance teams post-implementation creates recruitment costs, knowledge loss, and productivity gaps that can persist for years.

The Compounding Effect of Poor Planning

These hidden costs don’t exist in isolation they compound over time:

- Year 1: Excel workarounds seem manageable

- Year 2: Reporting gaps become critical business issues

- Year 3: Integration complexity makes simple changes expensive

- Year 4: Finance team turnover accelerates

- Year 5: The business questions the entire S/4HANA investment

The Finance-First Alternative

The solution isn’t more technology it’s better planning with finance leading the conversation from day one.

Before You Begin: The Critical Questions

- How will your current finance processes translate to S/4HANA?

- What reporting capabilities do you truly need versus want?

- How will your chart of accounts structure support future growth?

- What integration points are absolutely necessary?

- How will you measure success beyond technical go-live?

The Assessment Imperative

Smart CFOs invest in comprehensive finance readiness assessments before major decisions. A proper assessment reveals potential pitfalls while they’re still manageable, not after they’ve become expensive problems.

The right assessment should cover:

- Current state finance process maturity

- S/4HANA capability alignment

- Reporting and analytics requirements

- Integration complexity analysis

- Change management readiness

Your Next Step

If you’re considering an S/4HANA transformation or currently in planning phases, don’t let finance be an afterthought. The hidden costs of poor planning far exceed the investment in proper upfront assessment.

Consider starting with a comprehensive Finance Readiness & Optimization Assessment that provides clear visibility into potential risks and opportunities before they impact your project timeline and budget.

Remember: in S/4HANA transformations, what you don’t plan for will cost you far more than what you do.

Ugur Hasdemir is the founder of Innovativity, specializing in finance-first S/4HANA transformations. With 15+ years of hands-on S/4HANA Finance experience, he helps CFOs and finance leaders avoid the hidden costs of poor planning through independent, outcome-focused consulting services.