Let’s talk about something that often gets overlooked in CapEx-heavy projects: not all costs collected on a WBS element are meant to be capitalized.

Sounds basic, but this is where finance and project teams can trip over each other. You gather actual costs on a WBS, and before you know it, everything’s heading straight to the asset register until audit shows up and politely reminds you about capitalization rules.

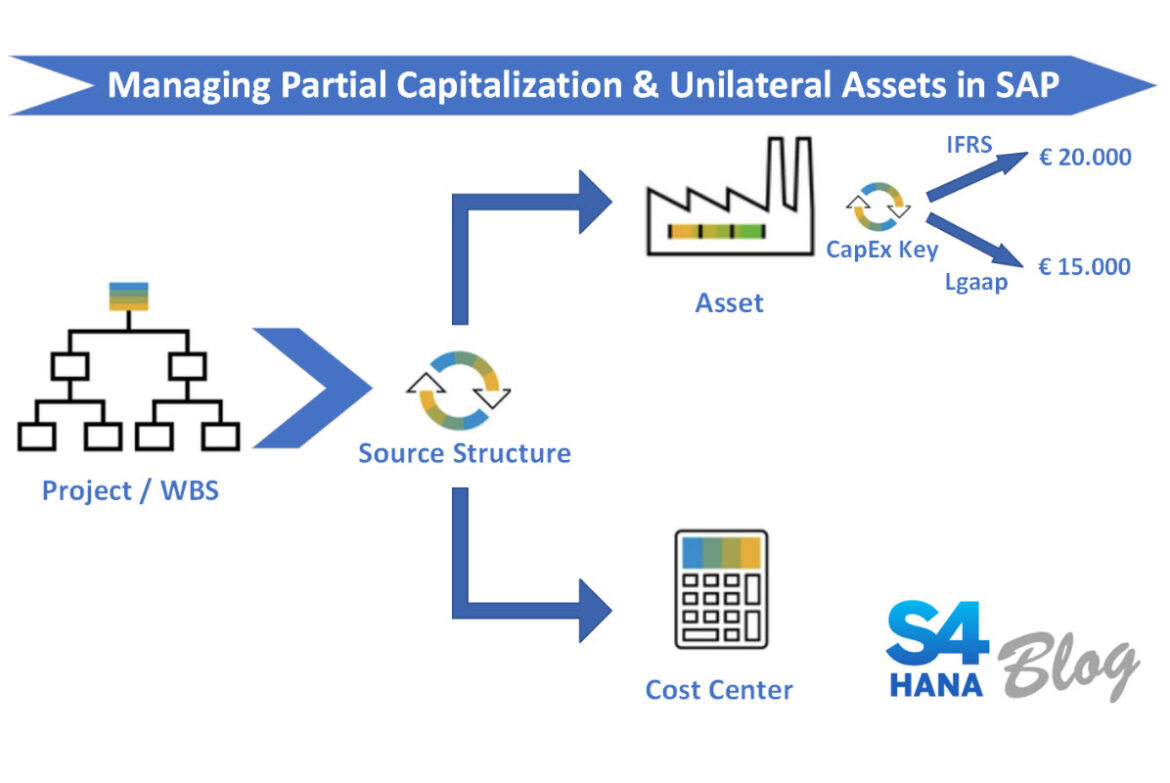

On top of that, welcome to the world of unilateral assets: where your IFRS books want to see a fully capitalized asset, but your local GAAP only agrees to partial capitalization. One asset, two realities.

In this post, I’ll walk you through how SAP supports these two scenarios:

- Controlling what’s allowed to be capitalized

- Handling asset values differently across accounting principles (aka, unilateral assets)

- I’ll also share an example setup.

1. Not Everything on a WBS Is CapEx and That’s a Good Thing

When you collect expenses on a WBS element, you’re just gathering costs. SAP doesn’t care (yet) if it’s capital or expense. But when it’s time to settle that WBS to an asset, the question is: what qualifies for capitalization?

Think of things like:

- Contractor fees directly related to the construction of the asset? Yes.

- Mobile expenses or office supplies during the project? Nope.

That’s where settlement rules alone aren’t enough. You need a way to filter out non-capitalizable costs before they hit the balance sheet.

SAP to the Rescue: Investment Profiles and Source Structures

SAP offers a few ways to control what gets capitalized:

- Investment Profile: Attached to your WBS element, it defines whether settlement is allowed to an asset and sets the rules for AUC (Asset Under Construction) management.

- Source Structure + Allocation Structure: Often overlooked, but powerful when used right. Source structures help group costs for settlements, and you can define rules per group. This is where you filter by account. You can restrict capitalization by excluding specific cost elements from being settled to an asset.

The key takeaway: you need a clear cost element strategy and SAP can enforce it. Once you setup a smart cost element hierarchy its easy to manage your source structures and manage CapEx based on clear rules.

2. Enter Unilateral Assets: When One Accounting Principle Says Yes, the Other Says No or partially

Let’s shift gears and talk about parallel accounting.

Imagine this: You’ve got a WBS collecting costs for an internal IT system. Under IFRS, the asset can be capitalized fully once it’s in use. But under local GAAP, maybe the rules are stricter or capitalization happens in phases.

You need to capitalize partially in one ledger and fully in another. That’s the concept of a unilateral asset.

How SAP Handles This with Parallel Valuation

SAP’s New Asset Accounting (mandatory in S/4HANA) is built exactly for this kind of thing. Here’s how it works:

- Each asset can carry multiple depreciation areas, each linked to a different accounting principle (e.g., IFRS vs Local GAAP).

- You can post values independently in each area so one asset may have a value of €100,000 in Area 01 (IFRS), but only €60,000 in Area 10 (Local GAAP).

- With the concept of Capitalization keys you can manage which cost elements or which percentage of cost posted on certain cost elements are allowed to be capitalized in certain valuation areas (ledgers / accounting principles)

Bonus: If you have Universal Parallel Accounting (UPA) activated in your system (active by default in Public Cloud), you can also use ledger specific settlement rules directly in the WBS to define how and when assets are capitalized in each ledger. This makes the capitalization key functionality obsolete.

3. Selective Capitalization Meets Unilateral Asset – Avoid GAAP Traps.

Here’s a simplified example from a recent project:

- A company was building a global data platform. Costs hit a WBS element, including hardware, software, consulting, and internal development.

- Part of the project costs are not allowed to be capitalized at all in none of the accounting principles. These costs must be settled to a cost center. In our example training costs.

- Under IFRS all costs are allowed to be capitalized from go-live onwards. Under Local GAAP, the indirect labor expenses are to be excluded.

- We configured:

- Depreciation areas in Asset Accounting for both ledgers, each with their own rules

- Capitalization keys in AuC to define the capitalization source per accounting principle. Here we exclude the indirect labor costs from Local GAAP capitalization

- Source structures to group capitalizable vs. non-capitalizable costs on the WBS

- Settlement rules that respected the logic of each accounting principle

Result? Clean books, happy auditors, and no manual adjustments after setllement.

4. The setup and results in S/4HANA

I will skip the basic setup of the depreciation areas in Asset Accounting and the setup of the settlement profile and allocation structure.

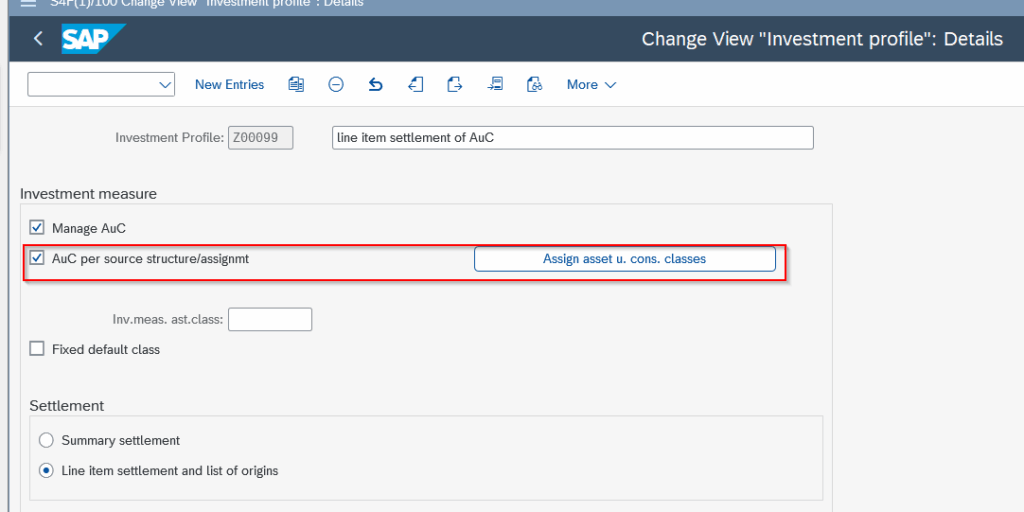

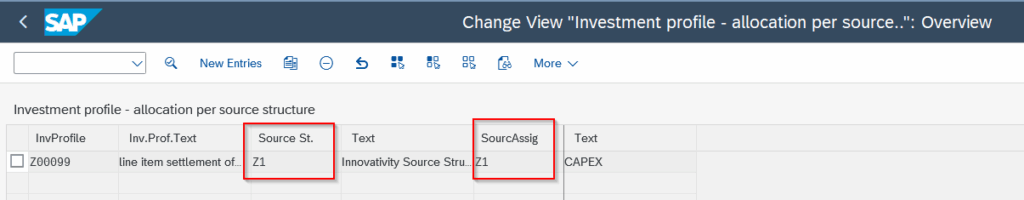

First we have to setup our Source Structure and Investment Profile. In my investment profile I will use AuC per source structure assignment. In this way I can exclude cartain assignment from being assigned to a AuC class.

As you can see only Source Assignment Z1 from my source structure is assigned to an AuC class in the ivestment profile. My other source assignment Z2 (not visible here) is for the OPEX costs.

With this setup of the Investment Profile I can split the cost to AuC and Cost Center with the settlement rules in my WBS.

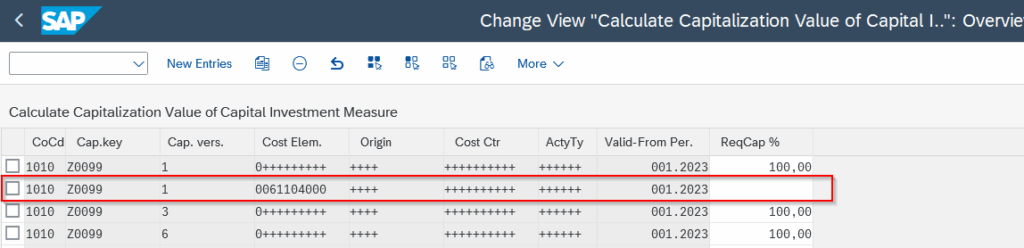

The nest step is to further steer the capitalization of the asset for the different Ledgers / Accounting Principles. I have to define a Capitalization Key for this purpose.

I have 3 Capitalization Versions (1,3 and 6) for each Ledger. Respectivly Local, Tax and IFRS. For every version I can define the capitalizaiton percentage and even exclude specific Cost Elements. In our case we have excluded cost element 61104000 from being capitalized in Local Ledger (percentage is 0).

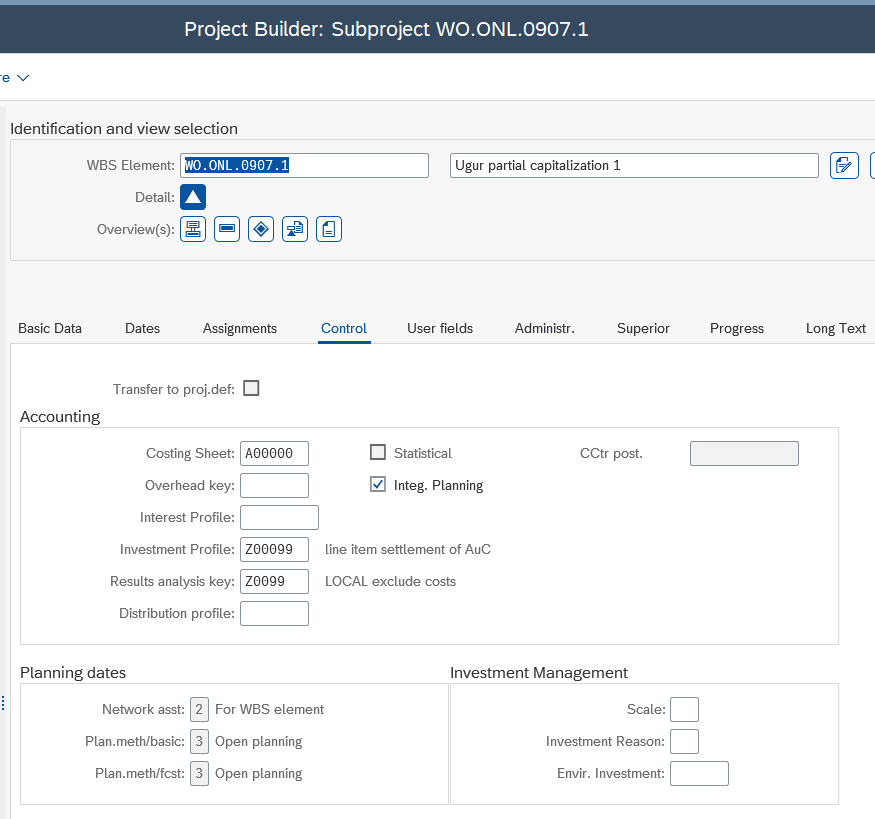

Now I will create my Project / WBS and assign the investment profile we have just defined. The result analysis key refers to the Capitalization Key we have defined in Asset Accounting.

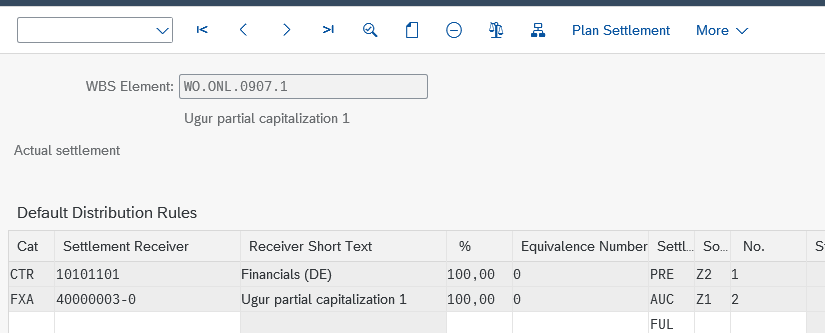

After the release of the WBS, the AuC will be created automatically. The settlement rules in my WBS can be seen below. The AuC rule is automatically populated after the first settlement run. The Cost Center rule is added be me to settle all costs which are not allowed to be capitalized according to my Source Structure. Pay attention to the Source Assignments! Z1 is for the CapEx, Z2 is for OPEX. Remember that Z2 was not assigned to my investment profile.

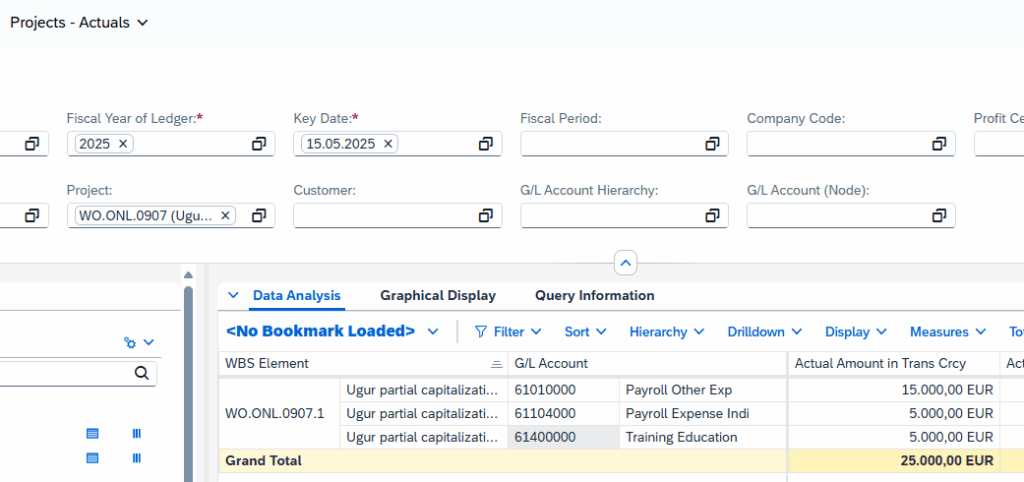

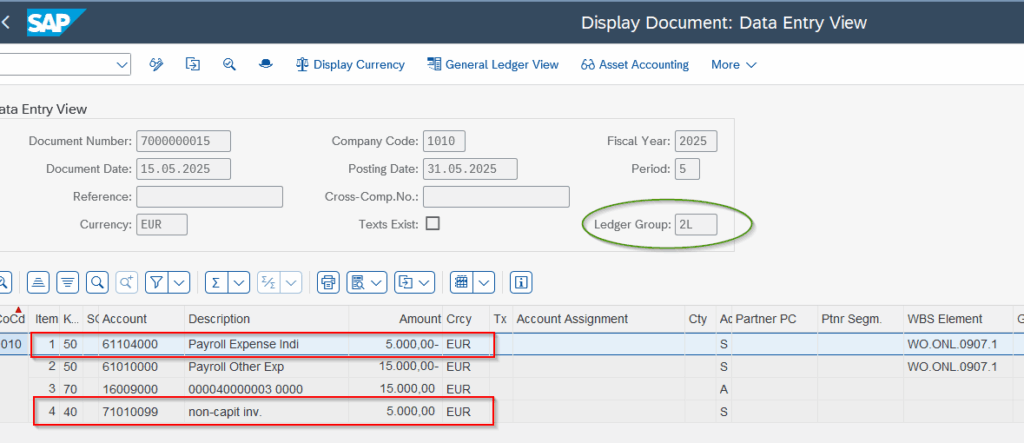

Now I will post actual expenses to my WBS. I have posted EUR 20.000 in total across 3 different cost elements.

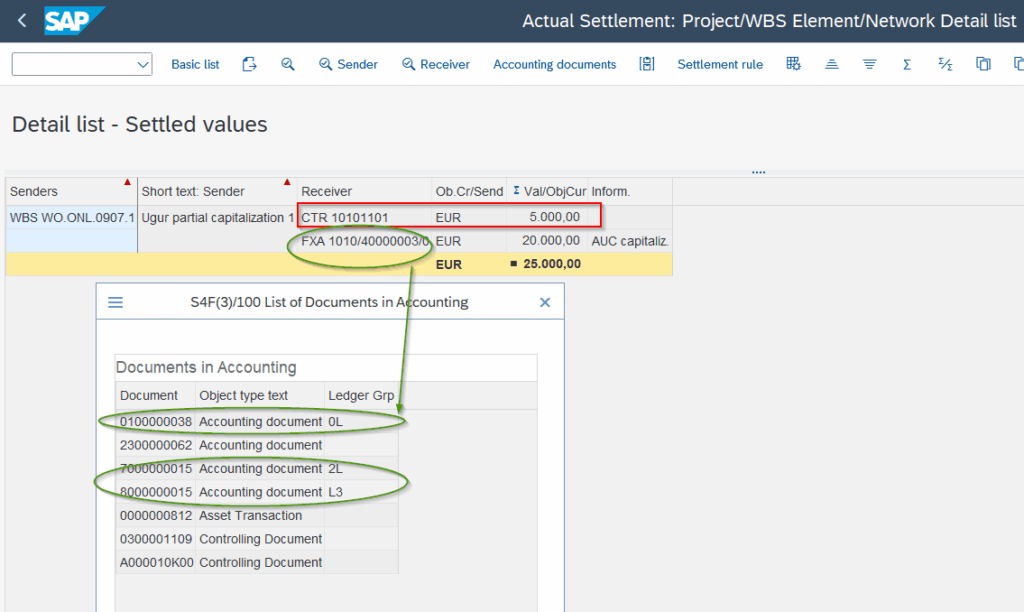

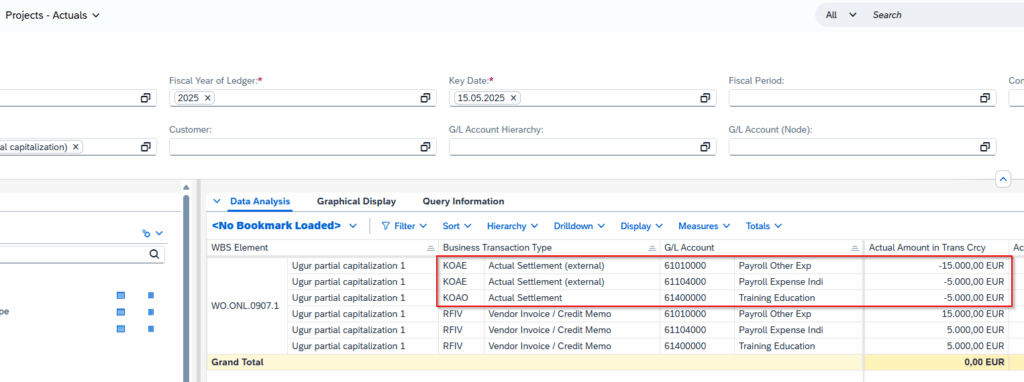

Now we will run the settlement for the current month. As expected we have 2 settlement receivers, the AuC and the Cost Center.

For the AuC we have 1 accounting document posted for each Ledger / Accounting Principle.

We will look into the Local Ledger (2L) posting in Asset Accounting specifically. Since for the Local Ledger we expect that a specifc Cost Element should be excluded from capitalization.

As you can see the expenses posted on account 61104000 are excluded from capitalization as defined in our CapEx Key customizing. The expense is posted to another P&L Account which is defined in customizing.

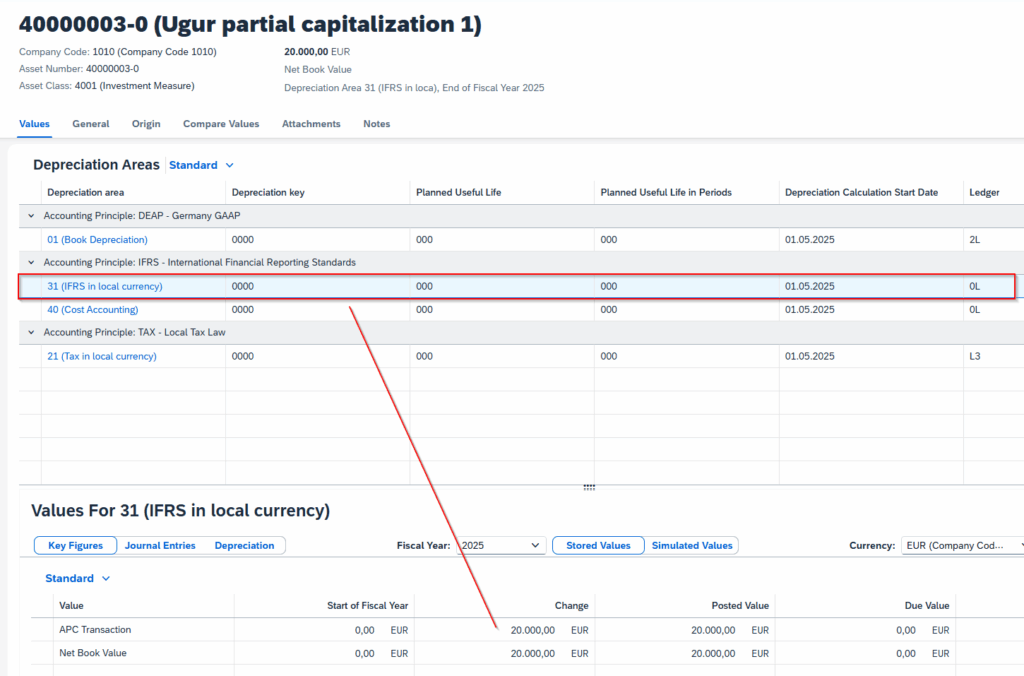

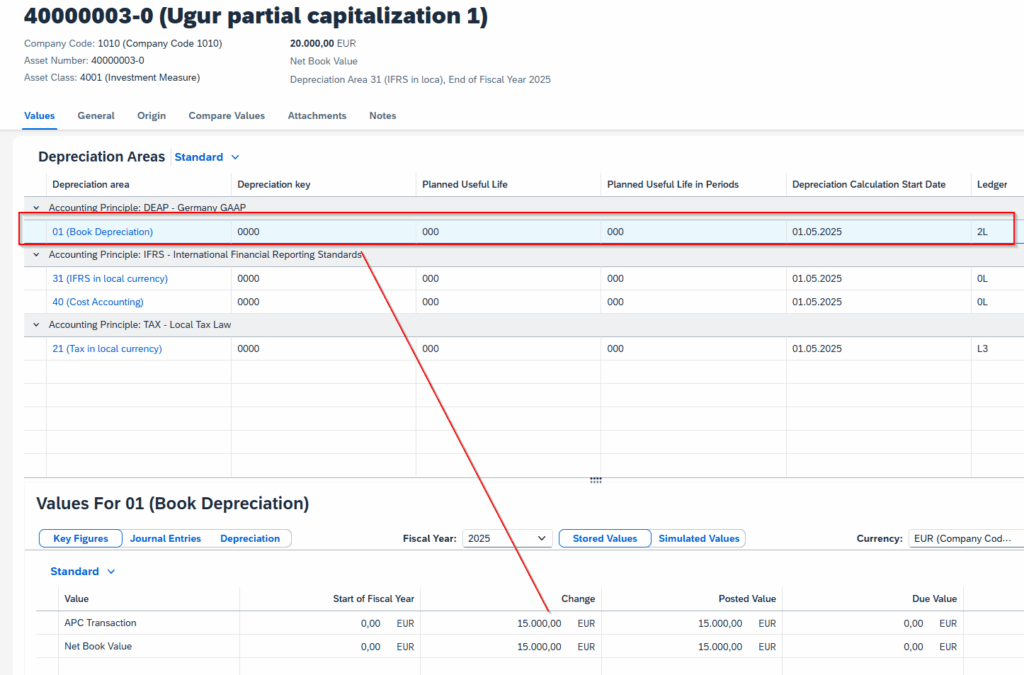

In the Asset Accounting Reports we can check the values of the asset across the different Ledgers:

Finally we can look at our WBS actual cost report to see that all expenses are settled

5. Final Thoughts: Clean Design Beats Cleanup

Too often, teams rely on manual reviews or journal entries to fix incorrect capitalization after the fact. That’s not only risky it’s avoidable.

With the right setup in SAP, you can:

- Enforce what qualifies for CapEx automatically. You need a crystal clear definition of your cost elements and smart setup of your cost element hierarchy to facilitate this

- Capitalize assets differently per accounting principle, without breaking consistency. Use the capitalization key functionality

And honestly, that’s where we as SAP consultants can really shine not just making the system “work,” but making it work right.

Want to get more out of your SAP system? Feel free to reach out!